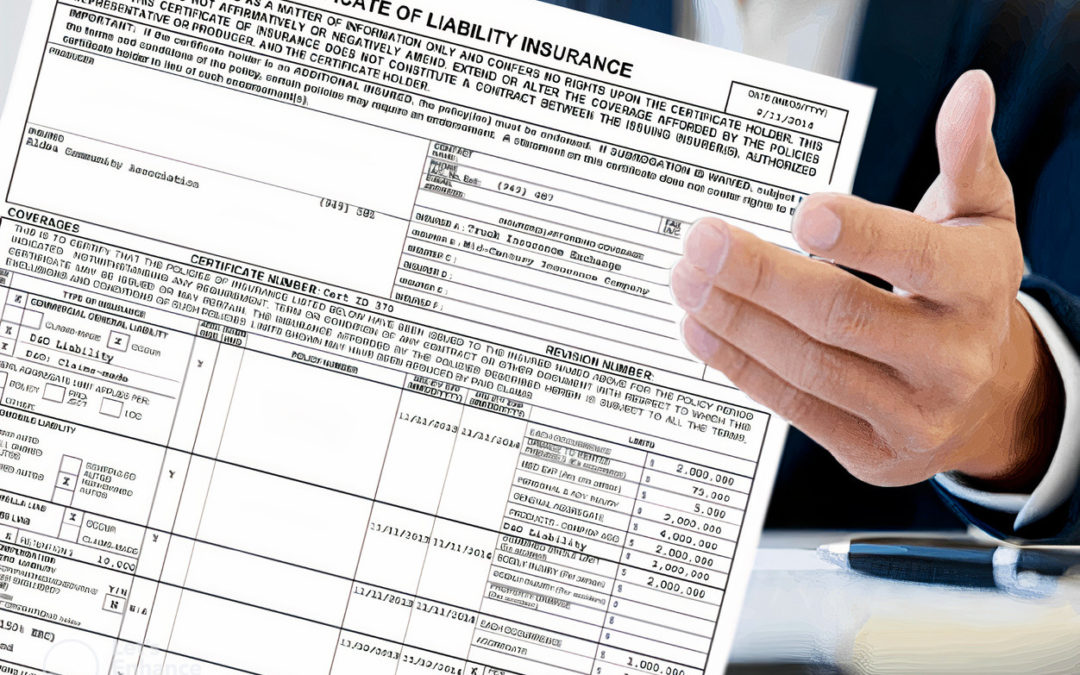

A certificate of insurance (COI) is a document that verifies that a business has active insurance coverage. It is typically requested by clients, vendors, or other businesses as proof that the company has the necessary insurance in place to protect against potential risks.

Having a COI can be beneficial for a variety of reasons. For one, it helps to establish credibility and professionalism for the business. By demonstrating that the business is insured, it shows that the company is prepared and responsible. This can be especially important for businesses that handle sensitive information or work with hazardous materials.

In addition to establishing credibility, a COI can also protect a business from potential legal liabilities. In the event that something goes wrong and a claim is filed against the business, having the proper insurance in place can help to minimize the financial impact.

Furthermore, many clients and vendors will require a COI before entering into a contract or agreement. This helps to ensure that both parties are protected in the event of an accident or incident.

It’s important to note that a COI is not the same thing as an insurance policy. It is simply a document that verifies the existence of an insurance policy. It is important for businesses to keep their insurance policies up-to-date and to provide COIs as needed.

In conclusion, obtaining and maintaining a certificate of insurance is crucial for any business. It helps to establish credibility, protect against legal liabilities, and can be a requirement for entering into contracts or agreements. Don’t put your business at risk – make sure you have a COI in place.

Recent Comments